SAVE 10%–25% MERCHANT CARD PROGRAM

By reviewing the merchant card statements, the Triage Team executes analytics to define cost opportunities in account structure, transaction fees and technologies.

The Triage Track Report will include analysis of the security exposure and automated account postings risk.

Triage Track Description

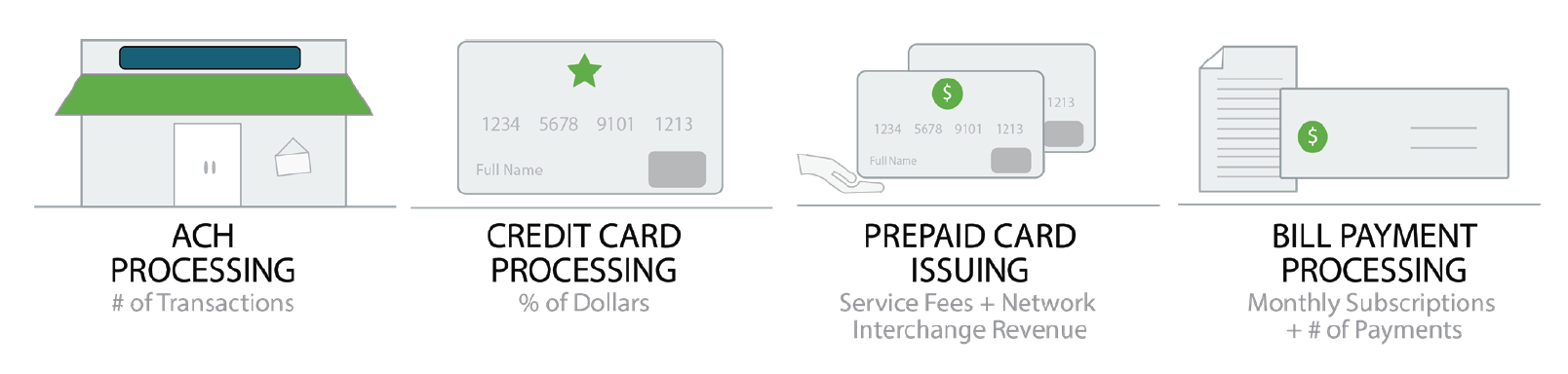

There are 3-main entities that make up the transaction cycle of any card used. They are Interchange, Card Brands and the Card Processors. Interchange pricing is set by the card brands. Brand costs are typically the smaller portion of the costs and provide for access, membership, fraud protection, authorization.

Card Processors costs vary greatly depending on the industry, volume, provider and structure. This is called the merchant service’s part of the equation and is where much of the improvement potential reside.

PROCESS

Client provides access to 3 to12 months of merchant statements. This will provide insight into the point of sale along with the information to define the card types and any non-essential fees.

Next step is to develop a process map of the service model. This will define the Merchant Service Providers and determine if the processor or gateway is PCI-Validated P2PE.

The monthly fees will be reconciled to volume to identify opportunities.

The card types (Business type cards, debit cards and purchase/virtual cards) will be inventoried and profiled.

Finally, our “Interchange Optimization Calculator” will process the profile and automatically provide the lowest card processing rates, which can be as much as a 50% reduction on business type cards.

ANALYSIS

This Merchant Card Triage Track analysis can identify opportunities to reduce cost and mitigate risk.